Monitor reputation indicators and ESG info to support investment choices and ensure compliance with European legislation

For investors and shareholders alike, a company’s sustainability, reliability and ethics matter. These factors—known as ESG—measure a company’s commitment and performance in the areas of climate change, corporate governance and human capital. For banks and other financial institutions, a company’s reputation and their ESG performance are key factors in the risk management process. However, the information that is relevant for ESG assessment is not easily available, it is often distributed across multiple sources and takes a long time to analyze.

Expert.ai compliance solutions enable companies to conduct a full range of ESG risk management activities, including: automatically analyzing stakeholder opinion, monitoring how indicators evolve in real-time, supplying rating algorithms with up-to-date and normalized data, and scoring different types of ESG indicators. This ensures alignment with factors that investors are increasingly paying attention to: transparency of sources, compliance with performance standards and alignment with the latest EU legislation that makes sustainability reporting mandatory for companies starting in 2024.

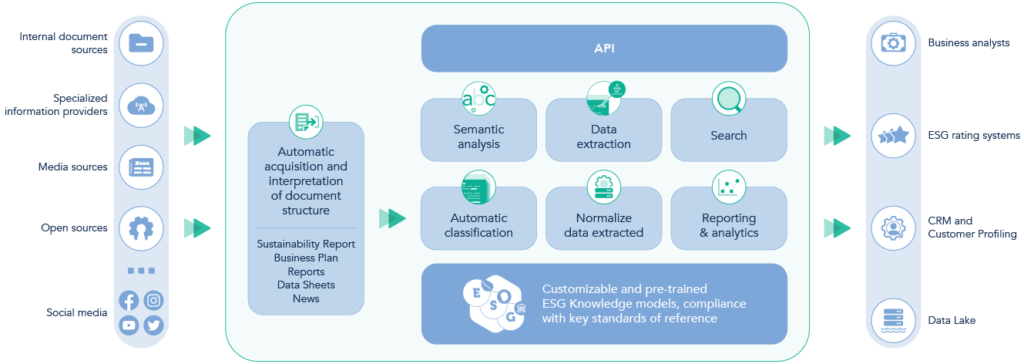

Artificial intelligence simplifies gathering information from multiple sources, organizing and analyzing it to understand how stakeholders assess the ethical sustainability of a company or brand (ESG Reputation), and for structuring and normalizing thousands of data points regarding an organization’s behaviors and ethical approach (ESG Performance).

Data acquisition

Acquires and understands all text content: internal and external documents, web sources, sustainability reports, supplementary notes, news, etc.

Categorization, extraction and normalization

Leverages a pre-trained ESG language model to identify, classify and extract metadata and other key information (certifications, emissions, investments, etc.) from any type of document to support analysis activities.

Support for ranking indicators

Ranks and score information about investments, initiatives, projects and policies that could have a positive impact on ESG indicators, as well as information related to emissions, sanctions, crimes or practices that could have a negative impact on ESG indicators.

Semantic search and dashboarding

Provides a platform for semantic search and dashboarding to support analysis of reputation information and a reporting tab for performance information.