How to streamline the processing of legal, medical and police records

Every day, insurance companies are inundated with packages of claims documents that are randomly formatted and in arbitrary order. Insurers must handle these complex packages and get human reviewers to manually examine, categorize and often transcribe important data from the many legal, medical and police records within a claim.

Ensuring data accuracy and quality becomes an uphill challenge when you’re dealing with such large amounts of unstructured data that require manual interpretation. That’s why “Submission Blindness” is a daily challenge that insurers face. The good news is that artificial intelligence technologies (AI) can help.

The Value of AI for Insurance Processes

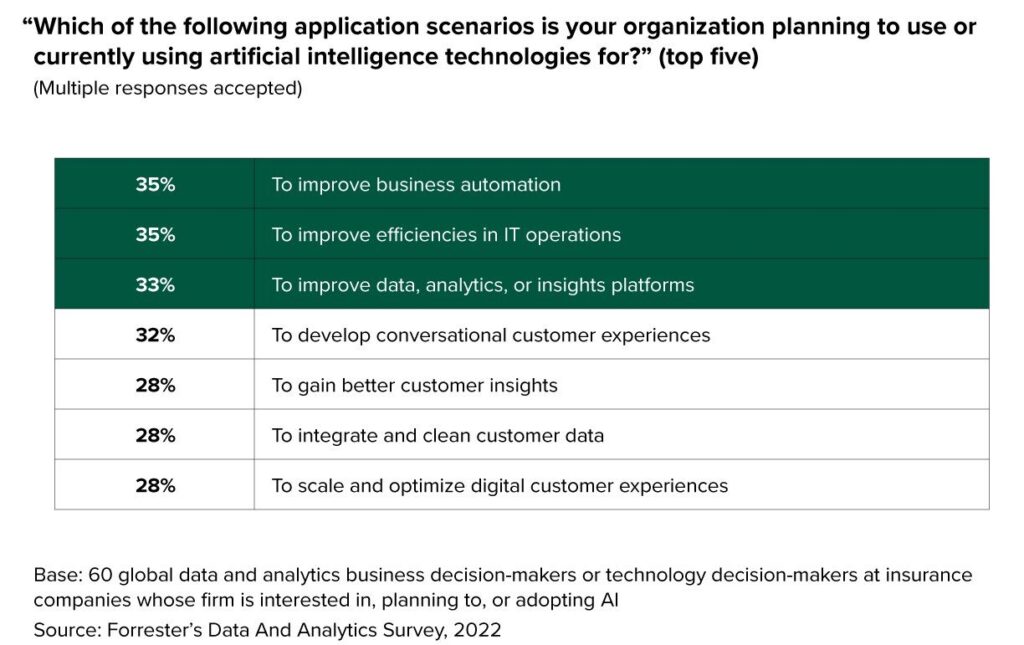

In fact, insurers are already using technologies like natural language processing (NLP) to address the challenges (and opportunity) of so much information.

According to Forrester Research, 35% of insurers are using AI to improve business automation, with a goal of reaching 70-80% straight through processing. This includes the document review process. Investment in NLP and AI solutions have proven to help insurers eliminate 30-40% of unnecessary document reviews and decrease their document review times by up to 90%. McKinsey suggests that by utilizing NLP technology, insurers can streamline the claims process and improve their combined ratios by up to five percentage points.

Is Submission Blindness Holding You Back?

If you’re dealing with large and complex insurance claims packages, see if any of these scenarios sound familiar:

- Volume of information: Large complex insurance claims packages can contain a vast amount of information, including policy documents, medical records, accident reports, legal documents, and more. Managing and processing such a high volume of information can be overwhelming, and teams may not have time to evaluate everything in a timely manner.

- Data organization: Insurance claims packages often consist of various types of data, such as text documents, images and multimedia files. Ensuring proper organization and structuring of this data is crucial for efficient processing and analysis. However, categorizing and extracting relevant information from unstructured data requires significant manual effort. As a result, important details may be overlooked.

- Data quality and accuracy: Large claims packages may have data quality issues, such as incomplete, inconsistent or erroneous information. This can lead to difficulties in assessing the validity of claims and making accurate decisions. Ensuring data accuracy and quality becomes even more challenging when dealing with unstructured data contained in medical reports, transcripts, depositions and other documentation that requires close manual review from a knowledgeable reviewer.

- Complexity and variability: Complex insurance claims packages often involve intricate details and varying coverage terms. Each claim may require a thorough understanding of the policy, legal obligations and specific circumstances. Analyzing and interpreting such complex claims can be time consuming and may require the expertise of specialists in different domains.

- Regulatory compliance: Insurance claims are subject to various regulations and compliance requirements. Large, complex claims packages require careful adherence to these regulations, including privacy laws, data protection and disclosure requirements. Balancing the need for compliance with efficiency can be challenging, especially when dealing with sensitive customer information and the need for data privacy.

- Fraud detection: Large claims packages present opportunities for fraudulent activities. Identifying potential fraud requires careful analysis and scrutiny of the provided information. However, detecting fraud within complex claims can be difficult, especially for very sophisticated fraud, as it often involves identifying patterns, anomalies and inconsistencies across various documents and data sources.

- Time sensitivity: Timely processing and resolution of large complex claims are crucial for customer satisfaction. However, due to the complexities involved, ensuring both efficiency with accuracy becomes a challenge, as insurance companies strive to provide quick responses while ensuring thorough investigation and evaluation.

Addressing these challenges requires a combination of advanced technologies, effective data management systems, robust analytical capabilities and skilled professionals. Natural Language Processing and AI play a significant role in streamlining the claims process, improving efficiency and enabling better decision making.

Insurers can use NLP to eliminate documents from review cycles and prioritize which claims need an expedited review or be assigned a senior adjuster based on likely complexity. Providing claims team members with a way to automate the repetitive tasks associated with document reviews and assessments frees up their time to focus on determining coverage and conducting preliminary investigations. This ultimately improves the satisfaction of claims handlers when they can focus on value added activities like communicating with customers and closing claims.

These are just some of the scenarios that we address in our livestream, “Overcoming Submission Blindness in Claims.”

In this session, we demonstrate how expert.ai can:

- Categorize and split complex claim submission packages by record type

- Extract different data based on a Demand Letter vs. Medical Record vs. Police Report vs. ACORD Form

- Estimate response urgency and the likely severity of the injury based on available records

Watch the session on demand on LinkedIn or on YouTube.