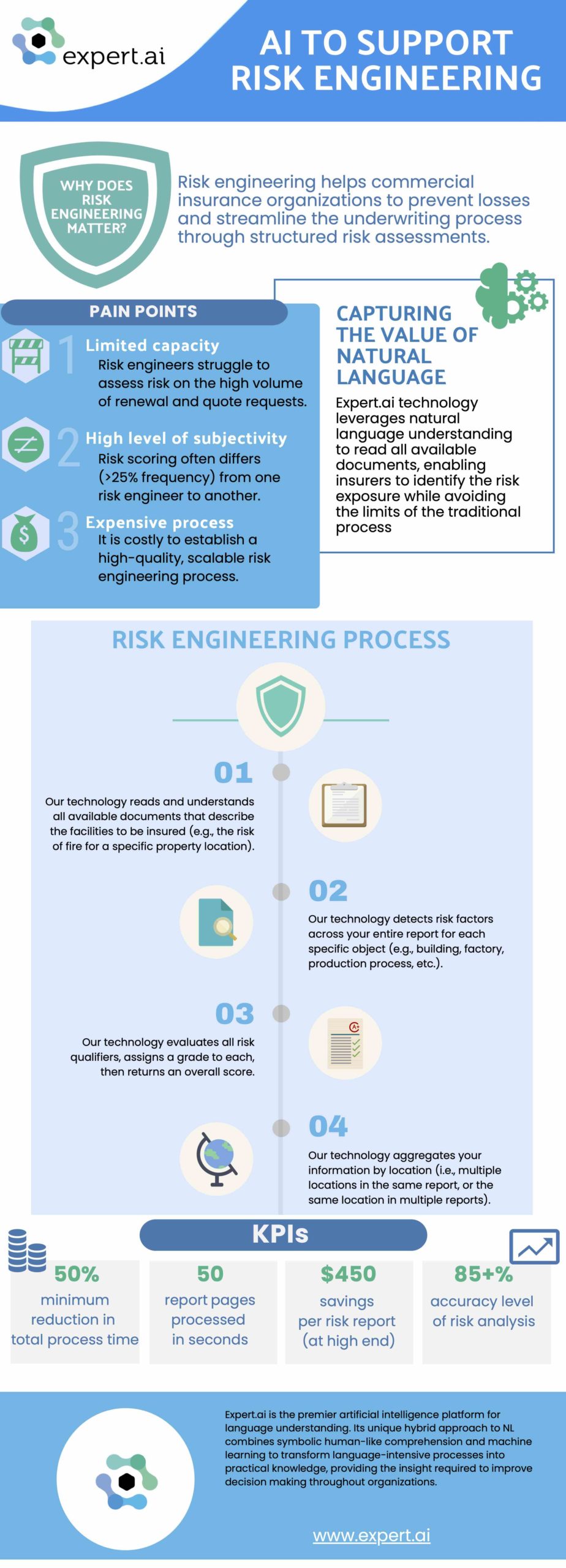

The insurance industry has long been inundated by tedious, time-consuming processes. The root of this issue can be attributed to the dense, text-heavy documentation weighing the processes down. Risk engineering is no exception to this challenge.

Risk evaluation surveys are central to the underwriting processes, providing critical information about buildings, factories, production processes and more. With this information, underwriters can evaluate critical risk factors and grade them based on the internally established grading standards.

While the process itself is relatively straightforward, executing it has become increasingly complex due to the volume of documentation required to analyze. Not only is this time consuming for underwriters, but it leads to scoring inconsistencies from one individual to another.

The Evolving Role of Risk Engineering

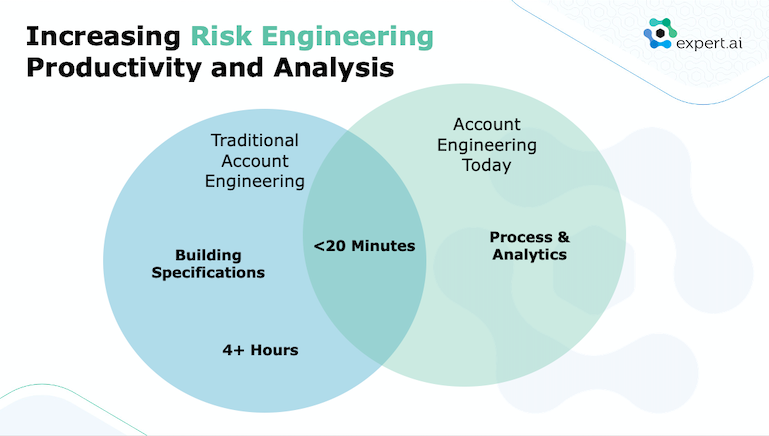

If only the solution to this issue was as easy as hiring additional risk engineers. While practical in theory, risk engineers are not only a scarce commodity, but roles will an evolving job description. Whereas traditional desktop assessments occupied the majority of a risk engineer’s time, it now only represents 20% of their full responsibilities – the rest focused on evaluating risk.

For insurance companies to effectively reduce their risk exposure in a consistent manner and maximize their internal resources, they must prioritize automation of the process. The only way to accomplish this is by establishing a symbolic approach to AI. This is where expert.ai’s natural language technology becomes so important.

Risk engineering is dependent on unstructured data. There is no way around this, so the longer you wait to identify a solution, the further behind you will be. Expert.ai not only has the NL technology to extract critical data from your documents, but a track record of success when it comes to streamlining the risk engineering process for goliaths of the insurance industry.

Don’t let an antiquated manual process prevent your organization from greater success. See how natural language understanding can fuel your digital transformation and make you into a team of experts.