The buzz around generative AI and large language models is shaping insurance company agendas and strategies as we speak. While companies are already experimenting and even using these new capabilities, there are many challenges to navigate and opportunities to explore.

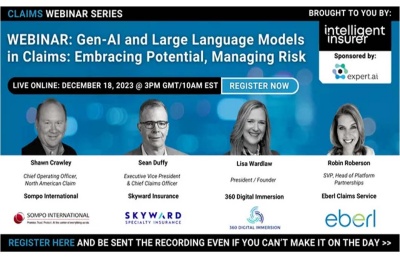

Last month, we sponsored a panel of insurance experts who came together to talk about the potential that AI offers for the insurance industry, the areas where insurers are already seeing value and the challenges they are up against to mitigate the risks.

For this webinar, host Robin Roberson from Eberl Claims Service talked to Shawn Crawley from Sompo International, Sean Duffy from Skyward Insurance and Lisa Wardlaw from 360 Digital Immersion and the Insurance Unplugged podcast.

Here are a few highlights from their conversation.

Insurance Experts Recommend: Get Your Foundation in Place

AI is set to be a leading item on the corporate agenda for 2024. The advancements in generative AI and LLMs, which have become integral parts of the AI toolkit, compel us to expand our perspective beyond mere functionalities and focus on the larger context. While the tools themselves are important, the very nature of AI demands that companies embrace a wider range of factors when formulating their AI strategy. This includes considering their data strategy, as well as the implications for sustainability, customers and technology.

That’s why a comprehensive regulatory framework is so important. As Lisa Wardlaw says, “You have to have an overall regulatory framework that your company subscribes to and operates within. These governance standards must persist beyond the function that you’re directly applying it to.” This sets the framework for everyone to act within, from chief claims officers, chief underwriting officers, to your head of data and AI and data science, etc.

Companies also have to be mindful of how regulations are evolving in different parts of the world where they do business. The US is different from Europe and within the US, regulation can vary state to state.

Strategy is another foundational component. The insurance experts on our panel agreed that your data strategy and your AI strategy must be aligned. Similarly, companies need guidelines and policies in place around employees using open source generative AI tools. As Sean Crawley said, “governing how your employees are going to be using these tools is so critical to the ultimate success of whatever deployment that you’re putting in place.”

Data Security Throughout the Ecosystem

As insurers add new AI tools to their toolbox, they need to be able to balance the new capabilities and what they can achieve with the same expectations for data quality and security that the industry demands. Personally identifiable data (PII) and proprietary data must be protected at all times. However, given the capabilities for analysis, companies often need more data than they have internally in order to mine for trends.

As Sean Duffy mentioned, while “there is an incredible wealth of data out there among carriers,” sometimes regulation can prevent using that data. Some insurers are using generative AI to create synthetic data or using open LLMs or a combination of open and closed LLMs to bring more data into the equation.

However, if you are using open LLMs or external vendors to build this for you, security and privacy must be factored into the procurement phase, says Sean Crawley. In general, make sure that your vendors all have the right data security measures in place, enforce your own protocols around PII data, and make sure you know what’s happening with your data from start to finish.

Show (and Celebrate) Quick Wins Along the Way

Insurance is a sector that has traditionally relied heavily on manual processes, but this is changing rapidly. Like other industries, insurers are embracing new technologies and tools that are transforming their daily operations. The advent of AI and related tools has revolutionized insurance processes, and the introduction of LLMs and ChatGPT has prompted many insurers to adopt AI technologies.

Given the pace of this evolution, it’s no surprise that many companies are experiencing a significant learning curve as they embrace new technologies. Asking people to trust something that is happening behind the scenes—something they cannot see—to make decisions takes time.

According to Sean Crawley, “change management across is probably the most critical piece to ultimate success of deploying AI.” Showing quick wins along the way is so important to early adoption and implementation. Getting buy-in at early adoption will be key to having folks who are along for the ride and for building faith in a new technology.

Think About What you Want to Enable

Finally, when it comes to AI, it’s easy to get caught up in the excitement and hype of new technologies and rush to use it for the sake of saying you’re “AI enabled.” All the insurance experts on the panel agreed that what AI really requires is getting practical. What are the problems it can help you solve and the use cases where it makes sense?

Whether it’s OCR, large language models, etc., AI is ultimately an “enabler” to do something, according to Sean Crawley. Turning data into actionable items in the claims management process, leveraging AI for analytics to identify the severity of a claim or deliver more insights to your underwriting teams are all some of the things that different AI tools can enable.

Conclusion

Ultimately, AI technologies are guiding the insurance industry toward a future characterized by innovation and adaptation. As companies navigate their own AI-driven transformations, there is a clear imperative to prioritize practical problem-solving, responsible deployment and proven data security over novelty.