Automate media monitoring and analysis to detect news about investigations and crimes involving customers or counterparties

Combating Anti-Money Laundering (AML) and other financial crimes is a growing concern for institutions, regulators and financial industry companies. The prevalence of illegal activities, faster transactions and strict regulatory requirements necessitate more rigorous and precise customer controls through dedicated Know Your Customer (KYC) approaches without overloading daily operations.

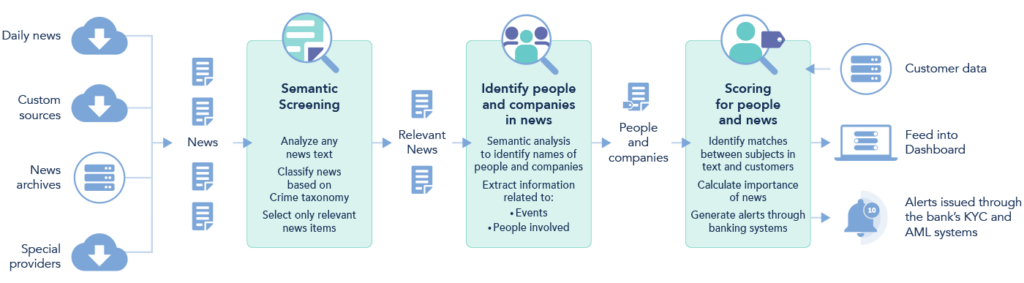

Through artificial intelligence applied to language, banks and financial organization can automatically and continuously monitor print and online sources of information to detect news of crimes, investigations or legal news concerning customers and counterparties.

Expert.ai’s compliance solutions analyzes massive volumes of news and unstructured data in multiple languages, automatically segmenting them according to specific criteria with speed, granularity and accuracy. It screens for “negative news” to meet the requirements of current regulations and support:

This allows you to identify customer, partner and vendor misconduct, take action to prevent it, ensure regulatory compliance and mitigate the risk of penalties.

Daily information monitoring

Analyze current news published by local and national newspapers and news outlets, news agencies, websites, and international news outlets, and access years of historical news archives.

Smart news screening

Leverage trained and tested AI algorithms to identify and classify crimes, recognizing more than 60 criminal offenses.

Extract and analyze key data

Extract key information in the news: individuals and/or companies, identifying information (age, profession, residence, etc.), and their role (e.g., suspected, arrested, accomplice, etc.) in the context of the events described.

Calculate news match and severity indicators

Customize scoring algorithms to assess the relevance and severity of a news item by determining if there is a match between a customer and people or companies mentioned in “negative news.”

Automatic alert streams

Automatically notify KYC and AML systems when banking customers are identified in news screening.