Finance & Banking

Insurance

Legal

Media & Publishing

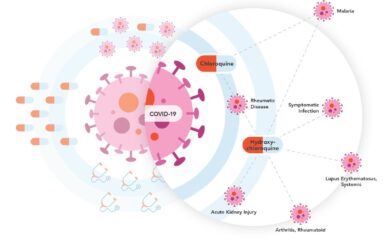

Pharma & Life Sciences

Public Sector

Claims Automation

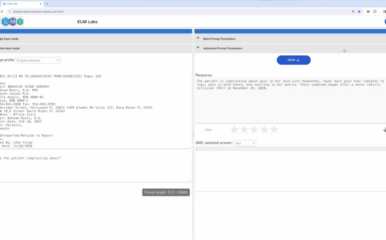

Clinical Insights

Clinical Trial Insights

Contract Analysis

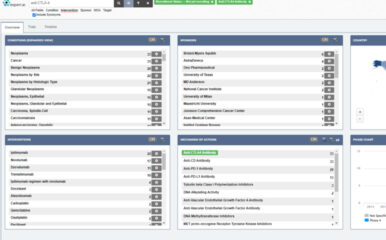

Drug Discovery

Email Management

Entity Extraction

Knowledge Discovery

Policy Review

Risk Engineering

Sentiment Analysis

Submission Intake

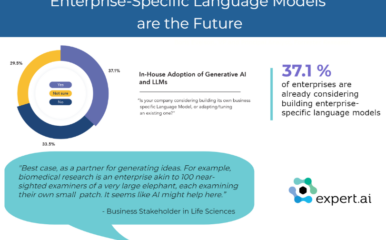

Artificial Intelligence

Chatbot

Classification

Customer Experience

Cyber

Deep Learning

Disambiguation

Email Management

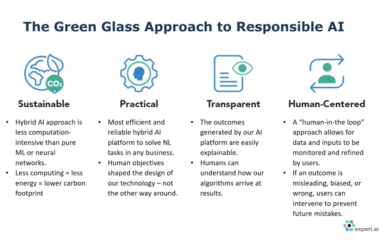

Explainable AI

Fake News

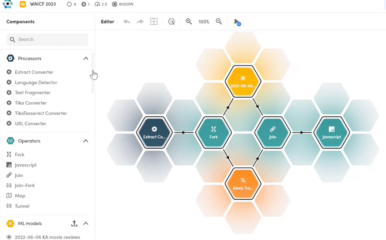

Hybrid AI

Knowledge Graph

Large Language Models (LLMs)

Machine Learning

Natural Language Processing (NLP)

Natural Language Understanding (NLU)

Responsible AI

Semantics

Symbolic AI

Taxonomy

Text Analytics