If we had to identify the priorities for today’s insurers, we could sum them up in four words: speed, cost, efficiency and innovation. To understand how to achieve these priorities, we can look to two letters: AI.

Today, the increasing use of artificial intelligence technologies like natural language processing (NLP) and intelligent document processing are helping insurers derive critical decision-making value from one of their most notoriously complex and high-volume sources of information: unstructured data.

As the use of AI becomes more widespread in insurance and the availability of new capabilities drive interest in transforming processes via a dramatic impact on combined ratios, the need to address the thorny issue of tackling unstructured data as part of the overall AI approach becomes a prerequisite for success.

Here, we’ll look at how fit-for-purpose AI models can help streamline and accelerate the claims management process.

The Digital Revolution in Insurance

Digitization has brought the availability of new technologies and new sources of information within reach. This has had multiple impacts. For one, insurers must prioritize becoming a data-driven enterprise in order to capture the flood of satellite, sensor, environmental and other real-time data to keep up.

Secondly, new customer demands have insurers prioritizing customer experience improvements and cost-optimization activities like straight-through processing over growth. This will require more customer data, aimed at personalization and cross-selling/upselling, and in turn, technologies that modernize existing processes.

AI and Language Technologies to the Rescue

Enter AI.

When it comes to using data to your advantage, AI is the solution. AI and language technologies can intelligently sort through large amounts of data and automate manual tasks that are repetitive and prone to error. This is especially important given the staffing shortage and the lack of employees who are able to execute these tasks.

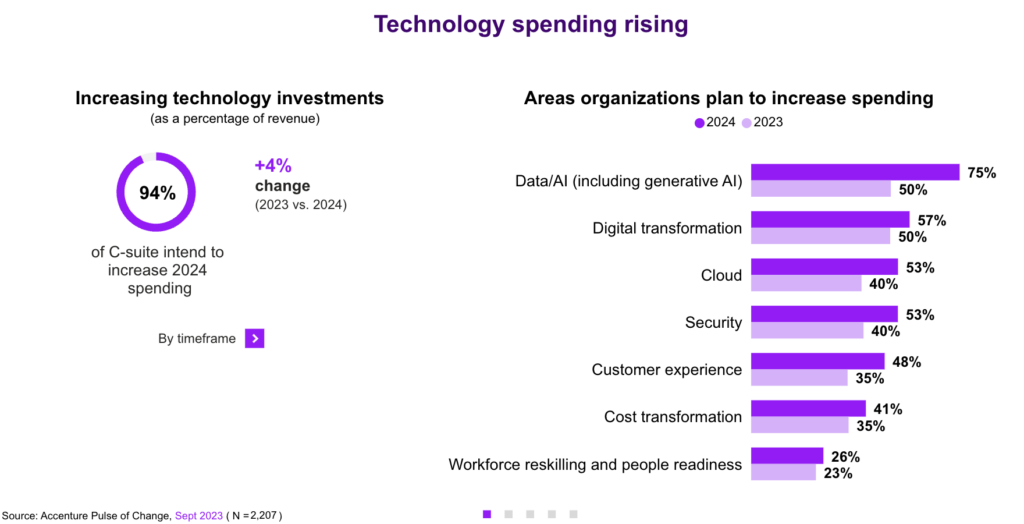

While 74% of insurers were planning to increase their investment in AI in 2022, the latest insurance outlook by Deloitte identifies AI, automation and advanced analytics capabilities as foundational for insurers to adapt to the complexities of a rapidly changing environment that ultimately puts customer experience at the forefront.

AI is already having a real impact on insurance companies who are employing it in some proven use cases: claims management, underwriting and risk management.

Today, insurers around the world are already making AI technologies like NLP a critical part of their strategy.

For The Hartford, AI is an essential part of an equation that will enable them to drive business outcomes and “bring capabilities to the end customer faster.”

At Allianz, “The use of AI is present throughout the organization and across the full insurance value chain.” The company is using AI to “simplify and speed up back-office operations and claims management,” where it is improving customer service and satisfaction.

But which “AI” capabilities are most commonly being leveraged?

In the last nine months, the popularity of applications like ChatGPT have brought attention to AI generally and created a sense of urgency within companies so they do not get left behind – the fear of missing out (FOMO). A June 2023 PWC Pulse survey found that 97% of C-suite leaders surveyed believed Generative AI will be “transformative” and a “game-changer.” This is bolstering overall investment in AI—up 20% from earlier this year—for leaders who see “getting data right” as the top challenge to be addressed.

These advancements have also brought widespread recognition of something that we have known all along: that AI can address language as a form of data.

AI is a broad definition of a range of capabilities. Language generation, which has been the focus of applications based on GPT, has become front-page news. However, NLP using symbolic AI, machine learning and large language models (LLMs) in combination, called Hybrid AI, are the technologies that deal with the messy realities of processing language data most optimally.

In fact, when you look at a typical insurance workflow—think claims management, underwriting, policy review, etc.—you will typically need to bring multiple capabilities to bear.

This is where a fit-for-purpose AI solution comes into play. We’re talking about a set of language models and linguistic and NLP capabilities built for the specific language, terminology and jargon of your working domain, and built to solve specific challenges in the world of insurance underwriting, claims, policies and risk management.

That’s because solving real-world problems that insurers face requires a combination of techniques to deliver the value that today’s complexity requires.

In other words, there is not a one-size-fits-all approach when it comes to solving language problems with technology. Instead, it’s about choosing the right tool for the job and the most effective, simplest approach that will deliver value.

Let’s look at a specific use case: medical records.

Use Case: Workers Compensation and AI Medical Records

Workers’ compensation claims represent a part of the business where several critical elements converge:

- Massive amounts of data

- Discrepancies and worse, missed information, could have major cost or legal implications

- Time to respond is key

Here, it’s important to specify the kind of “data” we’re talking about. Yes, numerical data is part of it. However, insurance is extremely language-data driven and very specific. Text—in documents, emails, forms, apps—is what powers so many insurance processes and workflows, and it’s notorious for being difficult to manage, especially for automation processes.

Language data plays a critical role at different parts of the insurance value chain. On the underwriting front end, pricing risk is important. At the back end, you have to pay out against the policies written. A tremendous amount of the really relevant information for these processes is captured in unstructured and semi-structured language.

Medical records represent a valuable language data workflow that is extremely complex.

The information contained in medical records is absolutely critical for adjusters in order to determine causation, verify coverage and assess damages. However, a submitted data packet may contain hundreds of documents and thousands of data points. This could consist of a wide variety of information types, in multiple formats (unstructured data, semi-structured data) and in no particular order. For example, claims data fields available for extract can include:

- Insured Details: Name, Address, Age, Policy Number, etc.

- Record types: Physical Therapy, Operative, Medical, Demand Letter, Invoices, CMS 1500 Form, ACORD Forms, etc.

- Medical Personnel and Facilities: Treating Doctor, Medical Facility Name & Address

- Demand Letter: Demand Amount, Response Due Date, Law Firm, Insured Name, Accident Date, etc.

- Medical Codes: Body parts, ICD codes showing patient diagnoses and CPT codes identifying services rendered

- Case Complexity and Severity: Derive from extracted values configurable conditions to set case complexity and urgency

Why is Language Important for Insurance Processes?

There are many reasons why language is so important for insurance processes. For example:

- The category of a document may be important for deciding whether a document requires human review.

- The urgency of a document may determine which team should look at what data.

- Key details could be buried within a document and easily overlooked.

But when you’re dealing with hundreds of pages and different types of documents you don’t yet know these facts. You must be able to untangle the chaos of any submission. This means representing it as a series of structured data points that can be used to form a coherent narrative. These data points can be re-sorted, reorganized or otherwise actioned for decision making.

Different document formats are the nature of the business, but this only complicates this process because you cannot apply the same techniques to different documents.

That’s why we use a hybrid AI approach. With the expert.ai Platform for Insurance, we can pass different types of information to different AI models to get the best results.

For example, a surgery note will most likely be in narrative format. Here, we use semantic understanding to determine the person involved, dates and other key diagnostic and treatment factors. A claim packet may also include a CMS form, a semi-structured document, that will need a different AI approach relying on computer vision in order to bound fields and extract different information.

Applying computer vision makes it possible to look at specific form fields based on templates or known formats that take advantage of form layout information (check boxes). This task would be error prone and time consuming for people. Machines can instantly and accurately cross reference ICD codes, etc. and provide structured data for decisioning mapped to your business rules to automate processing and save time.

The end result is to translate in context unstructured and semi-structured data into structured data so that the relevant data points for each kind of document can be surfaced for decisioning in your claims management system and mapped to your business rules in order to automate processing.

This allows claims managers to:

- Zero in on the facts that matter for the claim without having to read through every page of documentation

- Quickly set claim reserve requirements based on complexity and severity

- Get a view of the trajectory of the claim to understand what happened at the beginning, the middle and the end

- Highlight important information or anomalies buried in text

- Surface relevant data points for each kind of document for decisioning and process automation

To see this process step by step, watch this short demo to see the expert.ai Platform for Insurance in action.

Conclusion

In conclusion, the integration of AI and language processing is a game-changer for the insurance industry. It provides a vital solution for streamlining operations, adapting to new challenges and delivering a top-tier customer experience. By harnessing the power of AI to handle complex language data, including medical records, insurers are not just preparing for the future, but thriving in the present.